Credit Rating has gained significant importance amongst the investors in India and its financial markets. It gives the credit quality of the firm as it ensures the creditworthiness of the firm. It is suggesting an opinion on the credit quality of the firm, that is, the ability of the debt issuing firm to serve the debt instruments.

It ensures the relative capability of the corporate entity to serve its debt commitment in time concerning the instrument being rated.

Credit rating is in the form of alphabetical or alphanumerical characterization of the creditworthiness- individual, business, or instrument of a company. The ratings are merely check the creditworthiness, and it cannot be considered as a recommendation. The credit rating only talks about two important things one, its ability to pay and the willingness to pay.

These are the first established agencies in India.

a. CRISIL- Credit Rating And Services (India) Limited

b. ICRA Limited- Investment Information and Credit Agency of India Limited

c. CARE- Credit Analysis and Research Limited

d. Fitch Ratings India Private Ltd

LEGISLATIONS-The Credit Rating Agency is registered under the Securities Exchange Board of India. The SEBI registers, and it has the right to authorize and the right to regulate the credit rating agencies according to the SEBI Regulations, 1999 of the SEBI Act, 1992.

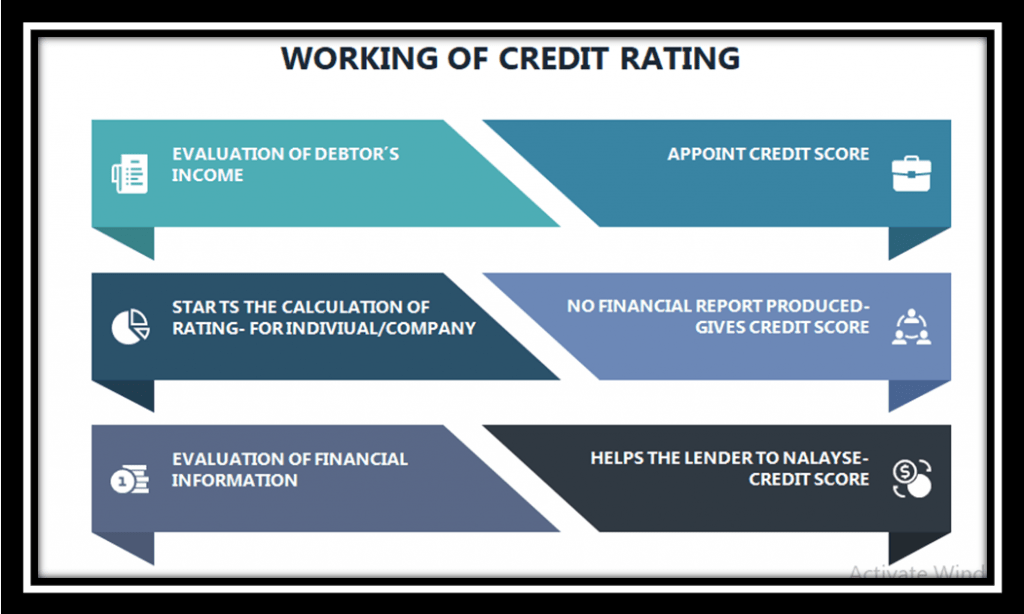

The Agency assesses and evaluates the creditworthiness of an individual or company.

They initially evaluate the debtor’s income and credit/ liabilities to analyze the debtor’s ability to repay the debt or if there is any risk associated with the debt.

These agencies have the right to evaluate and give a rating to the- companies, state governments, non-profit governments, countries, securities, local government bodies, and unique purpose entities.

Many factors are considered for setting up these ratings: financial statements, type of debts, lending and borrowing history, repayment capability, past credit repayment information, etc. These factors contribute to the computation of the rating of the organization/ individual/company.

It computes the result called A Credit Score.

The credit rating agency does not provide any financial report or decision, but such a Credit Score helps to know whether the entity should get the credit facility or not.

It helps the lender to analyze the credit information/credit score and making the reports or the decision easier for them.

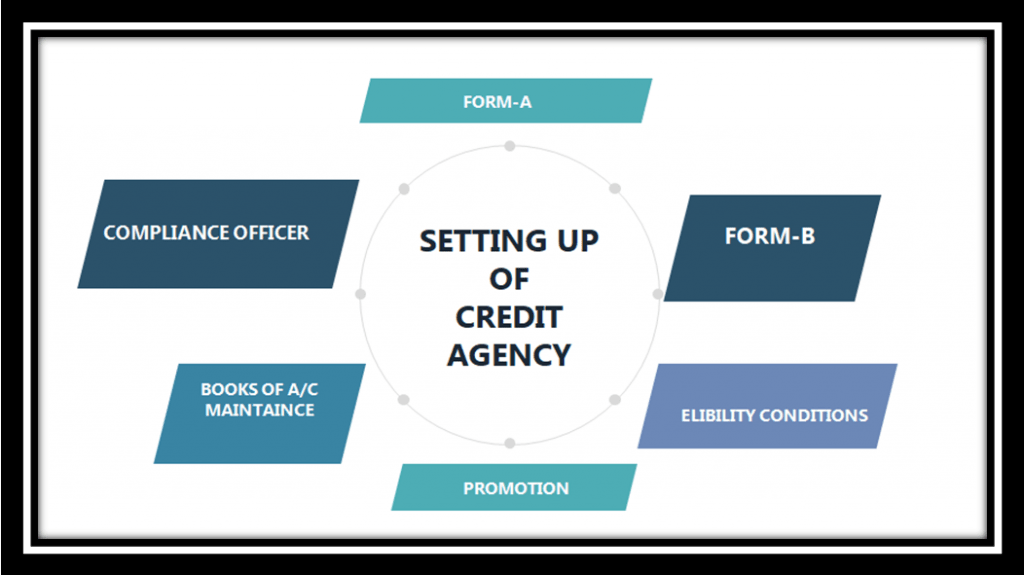

It is set up under the guidelines, as per the SEBI (Credit Rating Agencies) Regulations, 1999[1]:

Application has to be made in Form-A to SEBI, which is a non-refundable application fee form, to get the certificate of registration to carry out the activities of the credit rating agency.

The certificate of registrations shall be granted by the Board in Form-B.

The applicant must fulfill the eligibility conditions as laid down by the SEBI.

The promotion of credit rating agency by the following persons:

a. Public Financial Institutions, as defined by Section 4A of the Companies Act

b. Scheduled Commercial Banks

c. The Foreign Bank operating in India after the approval of Reserve Bank

d. The Foreign, Credit rating agency, having – 5 years experience in rating securities

e. Company/ Body Corporate having a net worth of Rupees 100 Crores, as per the annual audited accounts for the previous five years

Credit Rating Agency shall maintain the books of accounts and records for a minimum period of 5 years.

The Credit Rating agency shall appoint a compliance officer who shall take care of the compliances of various acts, rules, regulations, notifications, circulars, guidelines. etc

a. It has to define the rights and liabilities of the parties.

b. Fees charged have to be specified.

c. Tenure for the periodic review of the ratings.

d. The client discloses in the offer document the credit rating received for its listed securities.

e. The confidentiality of all the information disseminated by the client has to be ensured.

f. There shall be due diligence exercised to ensure that the rating assigned is fair and appropriate.

It can be concluded that the operation of the credit agency is like a private company. They have to assess the ability of the borrowers to repay the debt. The credit agency estimates the borrowers and issues some credit ratings based on the borrower’s solvency status. In India, the credit rating agencies have been established in 1980. The work is to evaluate the chance of the default on the borrower’s part in repayment of the loans.

There are no standard methods or scale to calculate its ratings for the credit risk, considering only the qualitative -business strategy of the company and quantitative financial data.

Read our article:Which is the Best Credit Bureau in India?

Experiencing the loss of a loved one is one of the deepest emotional hardships a person can fac...

On January 16, 2025, the Reserve Bank of India (RBI) released the list of Non-Banking Financial...

Over the decades, the Oil and Natural Gas Corporation (ONGC) has been a key pillar in the portf...

The Reserve Bank of India, on April 11, 2025, posted a Press Release No. 2025-2026/96 on their...

Hong Kong is widely recognized as a leading global business hub, known for its free-market econ...