We have witnessed a number of changes in the way we bank. We are discussing one of those methods in this article, i.e., Aadhaar enabled payment system.

It is a system developed by the National Payments Corporation of India that permits people to do financial transactions on a Micro-ATM by furnishing their Aadhaar number and verifying it with fingerprint or iris scan.

This method empowers people belonging to all sections of society to access banking and financial services through Aadhaar. It allows a person to transfer funds, make payments, deposit cash, etc. As the system operates on a centralized server, people can send money from their account to another account regardless of the bank in which the receiver’s account is operated.

It can also upgrade security as, under this process, there is no need to furnish bank details while carrying out transactions, and fingerprints of the account holder would be required for authorizing the transaction.

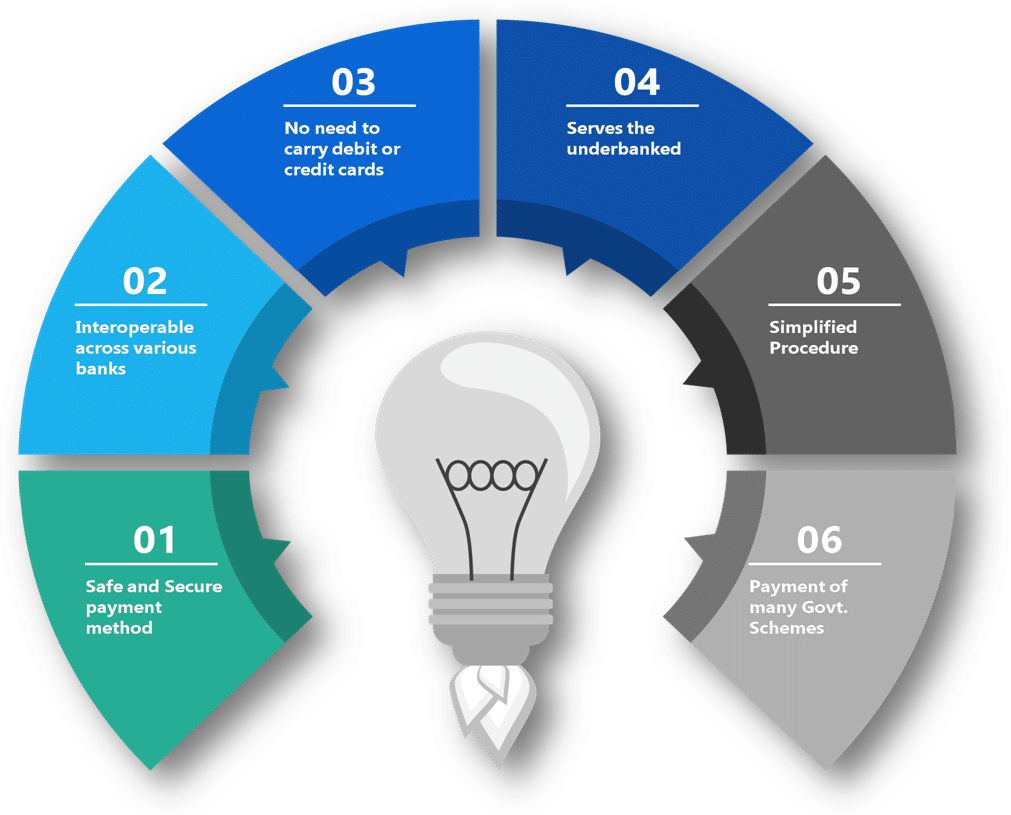

The benefits of this system are numerous, and some of them are as mentioned below:

This method is safe as fingerprint is required for transaction authentication.

Banking correspondents of one bank can perform transactions of other banks as well.

Users using this method for payment don’t require to furnish their debit or credit card.

With this method, the underbanked sections of the society can be served.

With this method, the only information needed to initiate a transaction is the Aadhaar number and biometric information.

This channel eases the payments of many government schemes such as Social Security Pension[1], NREGA handicapped Old Age Pension, etc. of Central or State Government bodies by way of Aadhaar Authentication.

People can avail a number of services through this system like the following:

The process of using this system is simple. It includes the following steps:

The government wanted to bring all citizens into the banking framework. However, it is tough to open bank branches in all remote villages. Therefore the government came up with this method where people from far off places would be easily able to send or receive money and avail of other banking facilities through micro ATMs and banking correspondents.

Also, considering the fact that it provides a safe mode of banking, this type of facility was launched. As stated earlier, transactions done through this method need biometric authentication through fingerprint/ iris scan. Therefore it is much safer than other methods. For example, physical signatures can easily be forged, but with a fingerprint/iris scan, it is not possible.

Various payments banks have adopted this method. In the next segment, we look at one of the banks that have adopted this.

Recently Paytm Payments Bank Limited enabled banking services through Aadhaar by integrating with the Aadhaar enabled payment system. In a statement, it said that its customers could access to basic banking services like cash withdrawal, balance inquiry, and obtain a mini statement through a business correspondent of any banking and financial institution.

It further added that features such as cash deposit and interbank fund transfer would also be made life that will benefit people in rural areas and semi-urban areas.

The Paytm Payments Bank has also partnered with more than 10,000 business correspondents who shall have access to a BC app for facilitating Aadhaar enabled transactions. The bank plans to add more correspondents to its network who shall serve customers of other banks.

It may be noted that the maximum amount is limited to 10,000 rupees per transaction. In case of cash withdrawal, the monthly limit is 50,000 rupees or ten transactions, whichever is reached earlier. Aadhaar enabled system is free for all customers of Paytm Payments Bank. The CEO and the Managing Director of Paytm Payments Bank said in a statement that with this channel, they are aiming to accelerate the financial inclusion in the country and also ensure that people in the remotest part of India are able to access banking services.

Before you use this new payment method, you must take note of the following points:

Read our article:Understanding the Concept of Statement of Financial Transaction (SFT) – Annual Information Return (AIR)

On January 16, 2025, the Reserve Bank of India (RBI) released the list of Non-Banking Financial...

Over the decades, the Oil and Natural Gas Corporation (ONGC) has been a key pillar in the portf...

The Reserve Bank of India, on April 11, 2025, posted a Press Release No. 2025-2026/96 on their...

Hong Kong is widely recognized as a leading global business hub, known for its free-market econ...

With India’s growing economy, Non-Banking Financial Companies (NBFCs) have expanded significa...